According to new research by Porsche-owned MHP Consulting, automotive buyers from Europe and China also differ dramatically in their attitudes to AI.

According to MHP’s latest mobility study ‘AI as a Game Changer: The New Driving Force of the Automotive Industry’ automotive buyers want AI-enhanced cars- without additional costs.

The international study which surveyed more than 4,700 participants found that 79% of European respondents were interested in AI-supported cars, but only 23% were willing to pay an extra charge for these functions.

This corresponds with the greater scepticism seen in Europe towards AI automotive integration.

By contrast China which has an automotive sector already enriched with the integration of large-scale AI models, is likelier to perceive in-car AI as an opportunity.

Almost half of Chinese respondents (47%) in the survey agreed with this sentiment.

This study provides fascinating insight into global user attitudes and expectations when it comes to AI-enhanced automation, highlighting prominent uncertainties and misconceptions.

But it’s not only users that are uncertain. Stakeholders across the value chain are undecided on how to best approach and adopt AI too.

The automotive industry is marked by caution towards AI, being slower to invest in AI teams, computing capacity and budgets.

This study by analysing the added value of using AI and highlighting prevailing misconceptions provides a means for automotive manufacturers to develop and execute a more competitive, informed and confident AI strategy.

AI & Automation: The state of global knowledge

Many vehicles already utilise AI for driver assistance systems, predictive maintenance, personalised entertainment and intelligent route planning amongst other functions.

But only 60% of respondents in the study said they understood the use of AI in cars.

From Chinese respondents this number was higher at 80%, and from European respondents it was lower at 54%.

The vast majority of respondents at 79% expressed interest in functions like intelligent route planning, driver assistance systems and predictive maintenance. But clearly not all understood how AI functions within these systems.

Evidently part of pursuing an effective AI strategy for automotive manufacturers is to address the knowledge gap when it comes to AI.

It’s a field that is frequently misunderstood and simplified across industries, and providing greater transparency and background information is likely to increase user confidence surrounding it.

Automotive manufacturers must be part of a collective effort to popularise the technology and educate consumers on the benefits they can experience from AI.

To begin this process European leaders should look to China, where cross collaboration between automotive manufacturers, technology firms and the government has created an automotive landscape and user base that is confident and informed about AI’s benefits.

Otherwise it will continue to be seen-in Europe at least-as a risk rather than an opportunity.

Too much risk, no reward

Only 23% of European respondents in the study saw in-car AI as an opportunity. Of these, 39% think that AI risk and opportunity is broadly balanced, whilst 24% take a negative view, believing risks currently outweigh the benefits.

In Europe due to stringent regulations, autonomous vehicles haven’t come as nearly into the mainstream as they have in China.

Furthermore, high-profile failures and accidents relating to self-driving cars like those of Tesla have contributed to negative perceptions.

This has fed into the willingness to adopt and especially pay for AI-supported enhancements.

84% of Chinese respondents said AI functions would motivate them to buy a vehicle, with this number only at 48% for European drivers.

If manufacturers were to charge for this, these numbers drop dramatically. 39% of the Chinese drivers would be willing to pay, and only 23% of European respondents

The study found a fixed extra charge would be accepted to the point of purchasing car, but significantly less so for activating later features or for flexible/monthly use.

Users wouldn’t buy in-vehicle AI applications, expecting these functions to be standard.

For manufacturers this means they need to align AI-based business models in vehicles to increase user experience while maximising financial benefit.

“The figures show that the prospect of greater safety and comfort due to AI can motivate purchasing decisions,” says Marcus Willand, partner at MHP and one of the authors of the study.

“However, the European respondents in particular are often hesitant and price-sensitive.”

How to use AI profitably in companies

So, how else do you embrace AI profitably as an automaker?

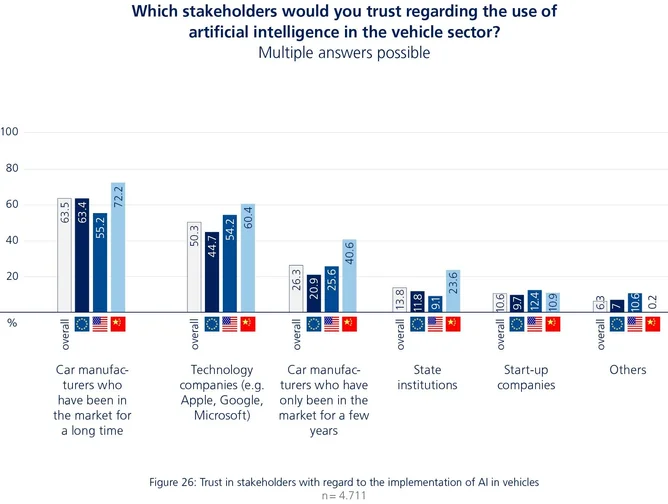

Well you’re already in a good position to do so. According to the study, customers trust established automotive manufacturers more when it comes to AI than technology firms like Microsoft, Apple and Google.

With this trust automotive manufacturers must build profitable and reliable business models, that will provide genuine, long-lasting value.

“Automotive companies need to create innovations with clear added value and develop both direct and indirect monetisation of their AI offerings, for example through data-based business models and improved services,” says Dr. Nils Schaupensteiner, Associated Partner at MHP and co-author of the study.

“The study also provides specific approaches for this.”

What are these specific approaches? We summarise below.

THE AI BUSINESS MODELS

- Pattern recognition: AI can recognise, categorise, and predict physical anomalies, enabling businesses to better respond to errors and trends and improve production quality.

- Data management: AI helps businesses harmonise large quantities of aggregated vehicle data that can be analysed and responded too.

- Decision-making: AI enables recommendation systems that speed up decision-making processes and provides information for price adjustments in regional mobility markets.

- Communication: AI-based chatbots and voice recognition/control simplify interaction between humans and machines, e.g. in customer service.

“It is worth OEMs and suppliers considering the opportunities offered by the new technology along their entire value chain,” says Augustin Friedel, senior manager and one of the authors of the study.

“However, the possible uses are diverse and implementation is quite complex.”

Indeed, the uses are diverse and implementation is complex. But we’ve already seen the profound benefits AI integration can provide for automotive manufacturers and customers alike.

But those benefits will not be truly realised in Europe unless a coherent value proposition is formulated, automotive manufacturers approach AI in a financially competitive way and the AI knowledge gap is addressed.